Bolstered by shifting travel patterns, innovative strategies, and a commitment to sustainable practices, Latin America is charting an upward trajectory in air service development. As we will explore in this latest collaboration with Canada-based AviaPro Consulting, the sector's evolution is marked by the expansion of low-cost carriers (LCCs), improved intra-regional connectivity, increasing international routes, and transformative investments in airport infrastructure.

The rise of low-cost carriers: democratizing the skies

The growth of low-cost carriers (LCCs) has redefined air travel in Latin America, making it more accessible and affordable. According to the International Air Transport Association (IATA), LCCs now account for over 40% of passenger traffic in the region. Between 2018 and 2023, passenger numbers on LCCs rose from 125 million to 165 million—a 32% jump.

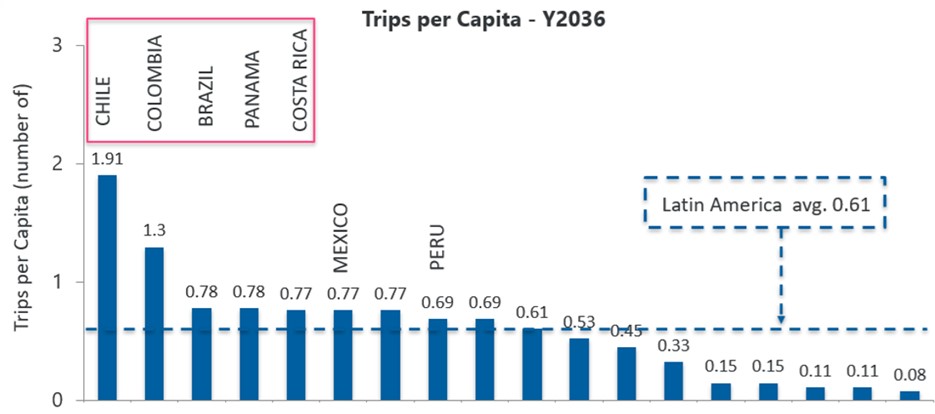

With an estimated population of 670 million in 2024, Latin America and the Caribbean present a significant opportunity for market growth in air travel. Currently, trips per capita in the region are projected to reach only 0.4 by 2026. However, this figure is expected to grow by 53%, reaching 0.61 by 2036, driven primarily by demand in Chile, Colombia, Brazil, Panama, and Costa Rica.

Source: Airbus, Sabre, IHS. - Passengers originating from respective country. Consultant analysis.

In addition, market leaders such as Gol Linhas Aéreas,Viva Aerobus, Volaris, SKY Airline, JetSmart and FlyBondi have revolutionized domestic travel in countries including Brazil, Mexico, Chile, Peru, Colombia and Argentina, fostering competition and prompting full-service airlines to adopt more competitive pricing models while reducing Cost per Available Seat Mile (CASM) to compete in a more cost-leveled field. This shift is not only expanding the market but also offering new travel opportunities to previously underserved populations.

Regional connectivity: the backbone of recovery

Latin America’s vast geography and cultural diversity make regional connectivity essential. Domestic flights accounted for 70% of total traffic in leading markets like Brazil and Mexico in 2023, with intra-regional traffic up by 12%. In addition, airlines are strengthening routes between key cities such as São Paulo, Buenos Aires, and Lima while exploring new regional hubs and secondary markets.

Short-haul flights have also emerged as a cornerstone of recovery strategies, offering travelers convenience and flexibility while driving growth in regional markets.

International growth: reconnecting with the world

As global travel demand recovers, Latin America is reconnecting with international markets, particularly in the U.S., Europe, and Asia. Non-stop long-haul routes are resurging, driven by business and leisure travel to cities such as Miami, Madrid, Frankfurt, and even Johannesburg.

In 2023, international routes to and from Latin America increased by 9% year-over-year. Carriers like American Airlines and LATAM Airlines are expanding their networks, with the U.S. remaining the region’s largest international market, accounting for 40% of total traffic.

According to OAG data, American Airlines, United Airlines and Volaris are the largest players on the cross-border US-Mexico market, accounting for almost half of all capacity (47%). Delta combined with Aeroméxico are the second biggest.

Infrastructure Investments: Building for the Future Latin America’s aviation sector is undergoing significant transformation, driven by $13 billion in upgrades to 56 existing airports and $11.4 billion allocated for 15 airport projects. These projects aim to accommodate rising passenger demand and improve regional connectivity, signaling a strong commitment to enhancing infrastructure across the region.

Brazil leads the effort with 19 projects, including the $1.4 billion expansion of Rio de Janeiro’s Galeão Airport and the long-term development of Campinas Viracopos Airport near São Paulo. Notably, these investments extend beyond major hubs, with mid-tier airports like these playing crucial roles in local economies and low-cost carrier operations.

Other key developments include Peru’s Chinchero Cusco Airport and Colombia’s Cartagena Airport, both designed to support growing tourism and regional growth. Major upgrades at Lima’s Jorge Chávez Airport and Santiago’s Arturo Merino Benítez Airport further highlight the region’s focus on long-term efficiency and capacity growth.

By modernizing airports of varying scales, Latin America is strategically positioning itself for post-pandemic aviation growth, improved connectivity and enhanced passenger experience while preparing for future sustainability challenges.

Sustainability at the forefront

Environmental responsibility is becoming a central focus for Latin American airlines. In 2023, regional carriers collectively reduced CO2 emissions by 8%, driven by fleet modernization and sustainability programs. For example, initiatives include carbon offset programs, investments in Sustainable Aviation Fuel (SAF), and commitments to achieving net-zero emissions by 2050.

In a previous article, we explored how Latin America is embracing sustainable aviation through a multifaceted approach that includes renewable energy integration, innovative technologies, robust regulatory frameworks, and community engagement. Efforts like the adoption of SAF, investment in fuel-efficient aircraft, and air traffic management optimization demonstrate the region's commitment to balancing economic growth with environmental stewardship.

Despite challenges such as economic constraints and the complexity of scaling green initiatives, collaboration among stakeholders—governments, airlines, airports and communities—offers a path forward, positioning the region as a leader in green aviation while preserving its unique ecosystems for future generations.

Collaboration and alliances

Strategic alliances and government partnerships are creating fertile ground for growth. Open skies agreements signed or renewed in 2023 have liberalized aviation policies across 14 countries, fostering competition and reducing airfares by 15% over the past five years.

Additionally, alliances like those between Avianca and Copa Airlines, and LATAM’s membership in the Oneworld Alliance, have expanded network offerings, improved connectivity, and enhanced the global competitiveness of regional carriers.

At a state level, Argentina has enacted sweeping reforms to liberalize its aviation sector, inviting foreign airlines to compete with state-run Aerolineas Argentinas, which currently dominates the domestic market. The decree removes price controls, allows unlimited route applications subject to safety approvals, and builds on "open-skies agreements" with countries like Brazil, Chile, and Canada, aiming to increase competition and flight options. While unions have criticized the changes as detrimental to Aerolineas and its workforce, the government led by President Javier Milei remains focused on fostering a more competitive and profitable aviation industry, with privatization of the state airline still a potential mid-term goal.

Embracing digital transformation

Technology is reshaping Latin America's aviation landscape, with artificial intelligence (AI) and machine learning (ML) at the forefront of innovation. Airlines in the region are increasingly adopting advanced AI/ML tools to enhance operations, such as dynamic pricing models that adjust airfares in real time based on competitive market conditions, maximizing revenue while catering to diverse customer needs.

By integrating cloud-based architectures and microservices, these technologies also optimize flight scheduling and passenger services, offering streamlined check-in systems and reduced wait times, which now benefit 85% of travelers. At the same time, dynamic pricing exemplifies how AI/ML applications are transforming revenue management by enabling airlines to move beyond static pricing models.

For example, Market Adaptive Pricing (MAP) systems analyze real-time data to fine-tune fare offers, balancing profitability and customer demand. This approach not only can increase revenue by up to 3% but also provides passengers with greater pricing flexibility and access to tailored offers. Combined with improved scalability and automation, these advancements signal a new era for Latin America's aviation industry, empowering airlines to deliver more efficient and customer-centric services.

Latin America’s aviation renaissance reflects the resilience and adaptability of the industry. By embracing innovation, sustainability, and strategic growth, the region is poised to continue its upward momentum. From the democratization of air travel to the recovery of premium segments, Latin America is setting a new standard for aviation in the post-pandemic world.