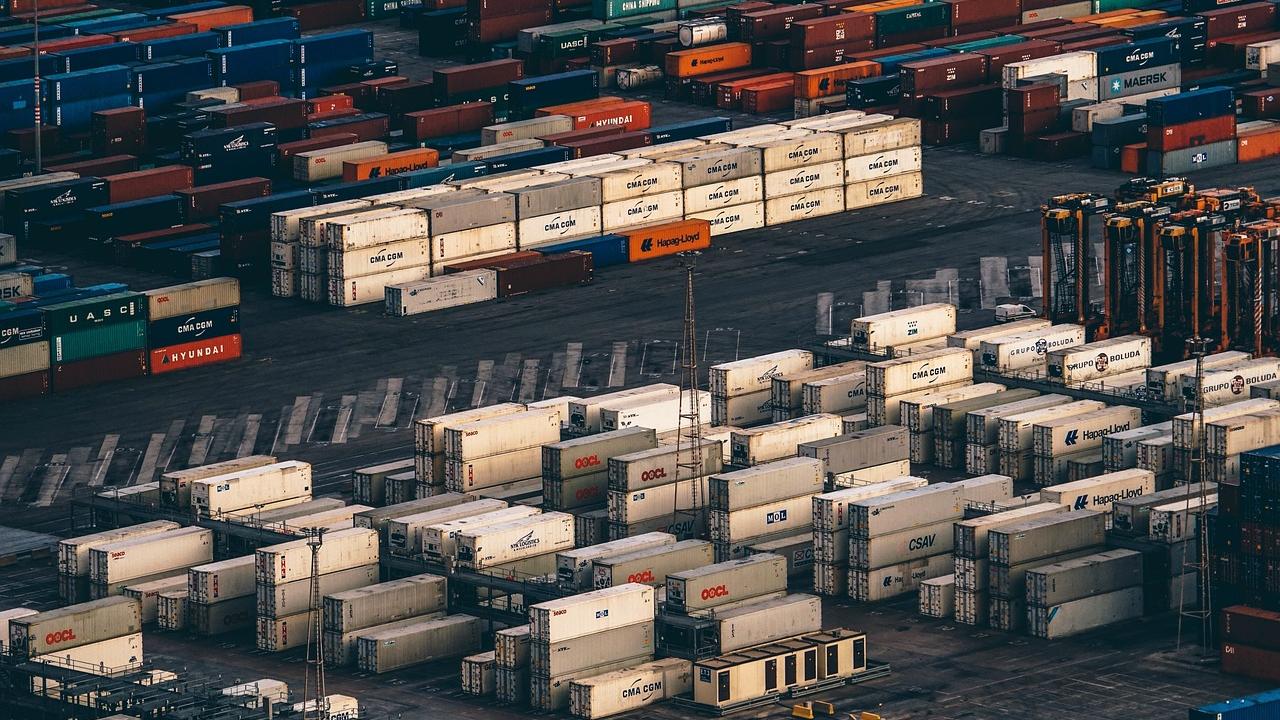

Among the Republican candidate's most notable policy proposals is his support for blanket tariffs of 60% on Chinese imports and 10% on all other imports, though this would likely meet with significant political pushback.

The outcome of the US elections, which will be held this Tuesday, November 5, could increase business uncertainty for Mexican companies, in a scenario in which aggressive unilateral tariff increases would lead to a reduction in Mexico's GDP of between 0.2% and 1.9%.

This is one of the main conclusions of a report prepared by Fitch Ratings, which states that Mexico's significant trade ties with the United States could leave companies significantly exposed to rising tariffs or other protectionist actions.

This exposure could increase trade uncertainties and dampen long-term growth if blanket tariffs are imposed and the business environment deteriorates structurally. However, these risks are mitigated by generally healthy financial profiles for Fitch-rated Mexican companies and favorable tailwinds from nearshoring trends.

The United States is Mexico’s largest trading partner, with exports accounting for more than 30% of Mexico’s GDP. A bipartisan consensus toward trade protectionism, industrial strategy, and rebuilding the U.S. manufacturing base could result in increased risks of tariffs or other protectionist measures that negatively affect Mexican companies.

Among Trump's most prominent policy proposals is his support for blanket tariffs of 60% on Chinese imports and 10% on all other imports, though this would likely meet with significant political pushback.

Increased trade friction with the United States could also have a broader negative impact on Mexico’s economy and dampen consumer spending. This could affect the retail, real estate and home construction, and food, beverage and tobacco sectors, which together account for around 40% of total revenues within the universe of Mexican companies rated by Fitch.