Gabriel Padilla, general director of the National Auto Parts Industry, explained that this investment would imply an increase of 23.5% compared to last year.

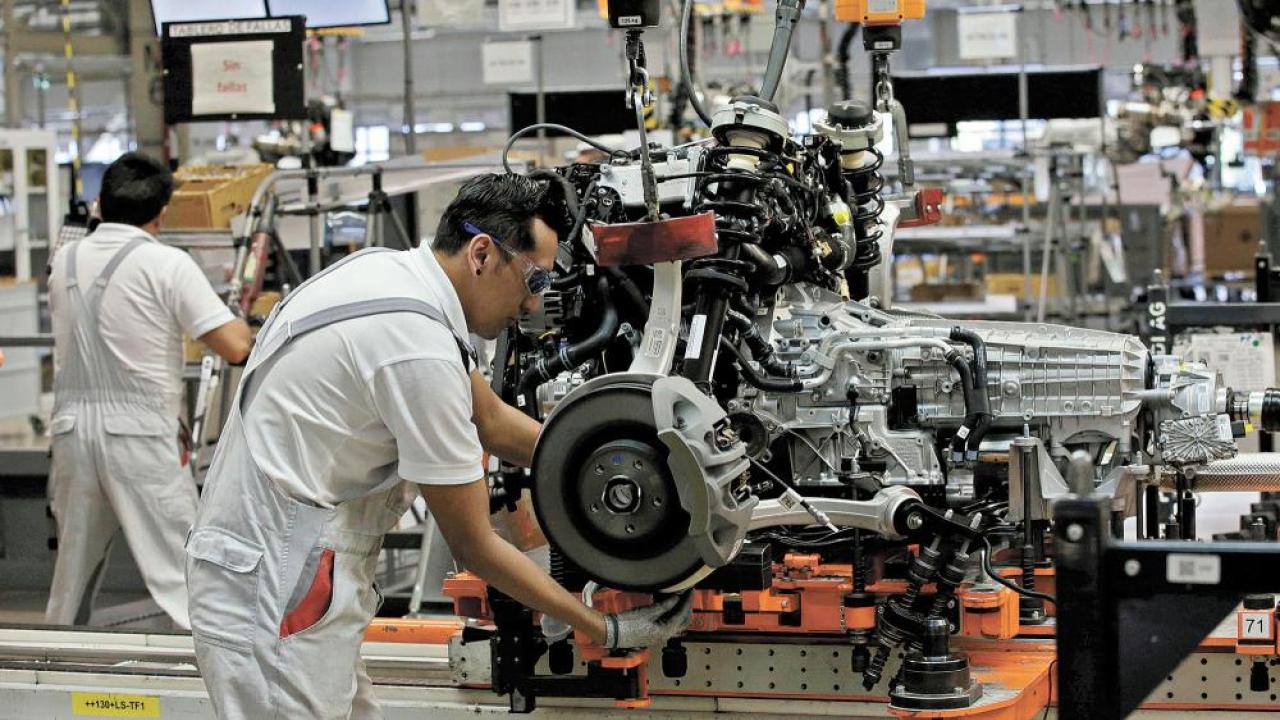

The National Auto Parts Industry of Mexico (INA) predicts that the parts and components sector will attract US$ 2.5 billion in Foreign Direct Investment (FDI) by the end of 2024, reflecting the growing interest of companies to operate from Mexico, move towards electromobility and meet sustainability challenges.

Gabriel Padilla, director general of the private organization, explained that this investment would imply an increase of 23.5% compared to last year.

Investment will continue to rise towards 2025, with an estimated US$2.7-2.8 billion expected to be received.

According to INA statistics, based on information from the Mexican Ministry of Economy, the auto parts sector in Mexico reached US$ 1,634 million in the first half of 2024, which represents an increase of 15.09% compared to the same period in 2023.

During the second half of the year, there was less dynamism in new investments, as a result of the political processes in Mexico and the United States, which caused uncertainty and perhaps an impasse among the business community.

The director of INA projected that the Aztec country is attractive for investments, especially German and American ones, since the industry is moving towards electromobility and the intensive use of manufacturing 4.0, with industrial processes that require specialized labor.

“In 2025, we will strengthen the programs with the academy to train the staff and be the spearhead of new investments,” he said.

For Padilla, the sustainability implemented by companies will also support investment attraction, due to international climate change commitments. As well as the increased performance of the automotive industry in manufacturing electric cars, “it is the opportunity to increase investments in the segment.”

One of the factors that will play an important role in the increase in the production of parts and components is the downward trend in inflation in North America. For example, inflation is expected to be between 2% and 2.1% in Canada and the United States, which strengthens demand from Mexico.

Even with a slowdown in 2025, the US will grow twice as fast and will be an important factor in the demand for cars, so that parts and components will increase. “There will be moderate growth, but it will continue to grow with a tendency to reach new records,” both in investment and in production and exports, said the director of the INA.

MORE TECHNOLOGICAL DEVELOPMENT

Gabriel Padilla said that strategies are being developed to boost sales, based on increasing technological development, so that greater investment is being observed in innovation, design and engineering centers and advanced manufacturing, as well as continuing to promote more specialized talent for new curricula.

In the wake of increased electric car manufacturing in the US, electrical auto parts such as harnesses lead domestic production with a 19.55 percent share. Other key segments include transmissions, clutches and their parts (9.95%), fabrics, carpets and seats (9.06%), as well as engine parts (7.86%), suspension and steering systems (6.67%).

Padilla Maya concluded: “Mexico has proven to be the most reliable ally for the automotive industry in North America. Our strategic position and our ability to adapt allow us not only to face the challenges of global trade, but also to consolidate ourselves as a pillar of stability for our partners.”

By September, the auto parts industry in Mexico had reached a turnover of US$93.143 billion, which represented a year-on-year increase of 3.2 percent.

Gabriel Padilla said that by achieving these unprecedented figures, Mexico is consolidating its position to meet production expectations for the end of the year with US$ 124.484 billion.

He highlighted that, during this period, Mexico's trade surplus in auto parts reached US$ 26,386 million, driven by exports to the United States and Canada.

“This consolidates Mexico as the main supplier of auto parts to the United States, with 43% of its total imports in this area. This performance reflects the strength of regional supply chains, which have been built over decades under deep integration schemes,” said the business leader.